It’s no secret that Milwaukee is currently building a lot of new shit, and that much of that new shit is apartments. But there’s a burning question lurking behind all that new development: Who, exactly, is moving into all of these new digs? And wouldn’t it make more sense to just buy a house instead of throwing away your money on rent for another 8,000 years? Happily, trusty Madison-based apartment listings site Abodo has some answers.

In a recently released report titled “Renting vs. Owning: A Profile of Milwaukee Housing Trends,” the folks at Abodo crunch five years’ worth of U.S. Census Bureau numbers (from 2011-2015) and come up with some interesting Milwaukee housing facts. Among them:

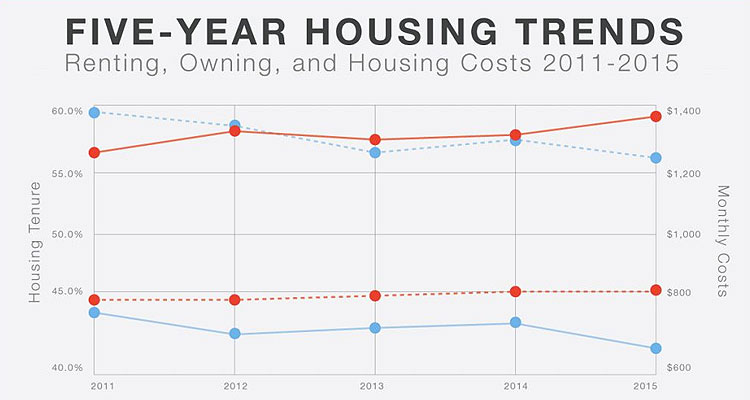

• Nearly 60% of Milwaukeeans are renters. That percentage is up from 57.2% in 2011.

• Despite the trend towards renting—along with an increase in monthly renting costs from $774 in 2011 to $802 in 2015—homeownership costs in Milwaukee have decreased. Mortgages and other monthly homeownership costs fell from $1,399 in 2011 to $1,257 in 2015.

• 57.7% of Milwaukee renters are cost-burdened, i.e. paying 30% or more of their income on housing costs. Only 34.4% of Milwaukee homeowners with a mortgage are cost-burdened. The national averages are 50.6% for renters, and 29.6% for homeowners.

• 39.1% of Milwaukee renters are below the poverty line, and 66.5% of those renters are single women. Nationally, 24.4% of renters are below the poverty line.

• 40% of Milwaukee renters are under the age of 35, while 34.3% are 35 to 54.

• Milwaukee is 38.5% black or African-American, 36.1% white, and 18.4% Hispanic or Latino. Yet 59.3% of Milwaukee homeowners are white, and only 24.7% of Milwaukee homeowners are black or African-American. In 2012, 27.1% of Milwaukee homeowners were black or African-American.

Read the entire report here. Start looking for a house here.