If you’ve been following our ongoing “here’s all the new shit they’re building in Milwaukee” series, you know that not only are they indeed building a lot of new shit in Milwaukee, but that most of that new shit is apartments. But who can afford these oft-“luxury” apartments, you ask, while scrounging up a fifth quarter for the washing machine in your building’s crappy laundry room/dungeon? Well, according to a new report, the answer is “men.”

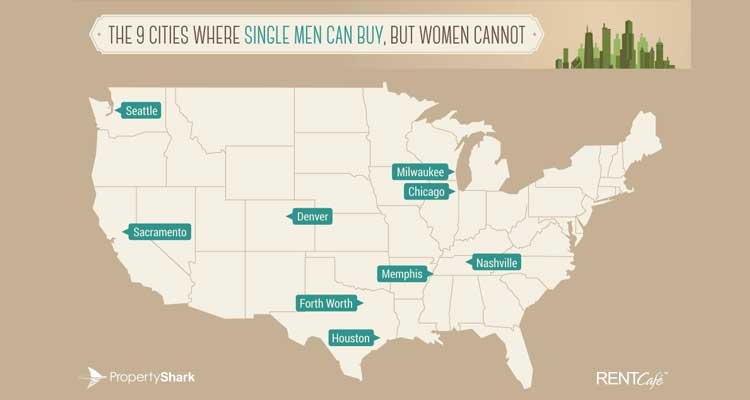

In a joint study compiled by PropertyShark and RENTCafe, the US housing market’s gender gap is explored by comparing rents and home prices in 50 cities to the average incomes of both men and women. The results identify nine cities where single men can afford to buy a home, while women cannot. Milwaukee is one of those nine cities.

Based on the rule of thumb that no more than 30% of your monthly income should go to either mortgage or rent, here are some not-so-fun facts from the report:

• On average, single Milwaukee men make approximately $24,187 a year. Single Milwaukee women make $21,353—$2,834 less than men.

• A monthly payment on a starter home makes up 31% of single women’s monthly income, compared to 27% for single men.

• The other eight cities where single men can afford to buy a starter home but single women cannot are Chicago, Seattle, Sacramento, Denver, Fort Worth, Houston, Memphis, and Nashville.

• Neither single Milwaukee men nor women can theoretically afford rent for a starter apartment. Men have to shell out 39% of their monthly income, while women have to part ways with 44%.

Click here for the full report and its methodology.